Types of Trusts

JLA Trust offers three types of Special Needs Trusts:

1st Party Trusts

- Set up & funded by the beneficiary themselves.

- Generally funded from unanticipated sources like a legal settlement, inheritance, GoFundMe, wages over the SSI monthly maximum, or even lottery winnings.

- $20,000 minimum funding to establish trust.

- Legally, there is a mandatory Medi-Cal payback following the death of the beneficiary.

- If the beneficiary passes with funds remaining, Medi-Cal must be paid back. JLA Trust will retain 10-50% for charitable purposes, and then pay off the Medi-Cal claim.

- Any remaining funds will go to named family heirs.

3rd Party Trusts

- Set up by a parent, grandparent, or other third party.

- Generally funded by parents, grandparents, or other third party with their own funds, life insurance, or a pension.

- $20,000 minimum funding to establish trust.

- A third party trust avoids the Medi-Cal payback that first party trusts must pay.

- Because of that, if the beneficiary passes with funds remaining, 90% will go to named family heirs. 10% will be retained by JLA for charitable purposes.

Future Funded Trusts

- A future funded trust is a type of 3rd Party Special Needs Trust designed to be funded not now, but later.

- Great for parents and guardians who want to leave money to their child with a disability without jeopardizing their government benefits, even if they aren’t ready to fund a Special Needs Trust today.

- Funding often comes from a life insurance policy, a home sale, or an estate: all of which can happen far in the future, after qualifying life events like death or disability of a parent. Leaving these funds to a special needs trust rather than your loved one with a disability directly is much easier than leaving them to establish a trust fund after your death.

- Can be established for $800: $200 minimum deposit in a Schwab money market account and $600 one-time enrollment fee to JLA Trust.

- $20,000 minimum must be reached before account becomes active and money can be disbursed.

JLA Trust provides Pooled Special Needs Trusts.

Pooled Special Needs Trusts are operated by nonprofits that “pool” the assets in many trusts together, so that your capital gains are higher and your legal and trustee fees are significantly lower. Below, we compare our pooled special needs trust model with your other options (solitary trust with family trustee and solitary trust with professional trustee).

Individual Trust with Family Trustee

- Family member, such as beneficiary’s sibling, takes on trustee role.

- Large legal setup fees to draft trust, but no ongoing trustee fees.

- Non-professional trustees may struggle to keep up with the complexities of their trustee role on top of their own life and career. As an administrator of a special needs trust, they are responsible for keeping on top of changing rules and liabilities surrounding trusts, taxes, and government benefits.

- Trusteeship is a lot of work, and there is strong potential for conflict of interest between the trustee and beneficiary.

Individual Trust with Professional Trustee

- Trustee role taken on by a professional, licensed fiduciary who may work at a bank, law firm, or commercial trust company.

- A professional trustee is very comfortable with their legal role as trustee and any changing rules surrounding trusts, taxes, and government benefits: it’s their job to be on top of this.

- Most expensive option, as you must pay a lawyer to draft the trust and also pay ongoing trustee fees.

- Most professional trustees require a $500,000 – $1,000,000 trust minimum before they are willing to offer their services.

Pooled Special Needs Trust

- Legally must be managed by a non-profit organization, such as JLA Trust.

- Access to a professional trustee at a lower minimum and for a lower rate (since all trusts are pooled together to meet minimum and pay for the trustee’s time).

- Significantly reduced legal fees, since you are not paying a lawyer to draw up a Special Needs Trust from scratch, but instead “joining” our Master Trust (which was drafted by one of the leading Special Needs Trust experts!)

- Pooled trusts give you all the advantages of professional trusteeship… at a much more reasonable price.

With any of our trust types, you select how you want your money invested.

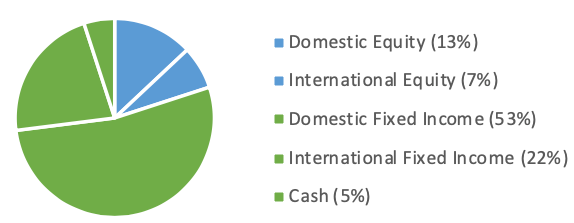

Conservative

Trust funds are invested carefully and conservatively but still with potential gains, with 80% fixed income and 20% equity.

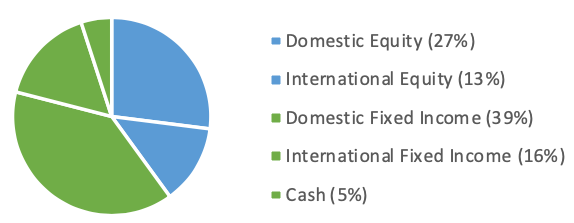

Conservative Growth

Trust funds are invested with a little more risk and a little more potential gain than conservative, with 60% fixed income and 40% equity.

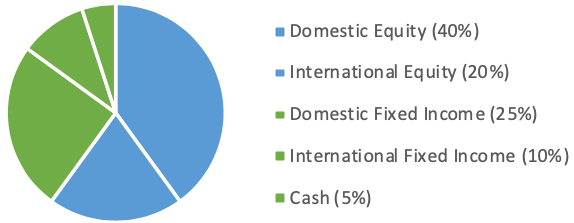

Moderate

Our greatest potential returns for those who want to take on a little more risk. A moderate growth portfolio is 40% fixed income and 60% equity.