Costs & Fees

For active trusts, JLA Trust assesses a flat enrollment fee of $1,300 at trust opening and an annual trustee fee, which scales depending on assets in the trust. These fees cover all of your ongoing trustee services and 2 hours of customer service time every month.

Our Trust management partner, True Link Financial, assesses a 1% annual trust management fee.

You can download our full fee schedule by clicking here, or read below for more details about our fees and how we assess them.

Enrollment Costs

JLA Trust charges a flat enrollment fee of $1,300 to active trusts when they are established.

A minimum of $20,000 in trust funds is required to establish an active trust at JLA.

Future Funded Enrollment Costs

JLA Trust’s Future Funded Trust program allows you to establish an inactive trust for future use. We charge a $600 enrollment fee with a minimum trust funding of $200.

No annual fees are assessed while the account is inactive, and no disbursements can be made until the account is funded with the $20,000 minimum.

Ongoing Costs

Your annual trustee fee paid to JLA Trust depends on the size of your trust.

Trusts between $20,000 and $60,000 will owe $800.

Trusts between $60,001 and $150,000 will owe $1,325.

Trusts between $150,001 and $350,000 will owe $3,100.

Trusts between $350,000 and $500,000 will owe $4,200.

Trusts over $500,001 will owe 1%.

This fee is assessed each year on the anniversary of trust establishment and covers ongoing trustee costs and up to two hours per month of customer service.

Our partner, True Link Financial, takes an annual fee of 1% which is assessed quarterly.

Sound complicated? The examples below can give you a better idea of what these fees look like in practice.

The True Value of A Trust

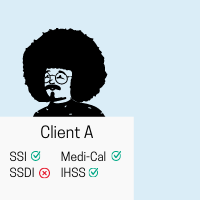

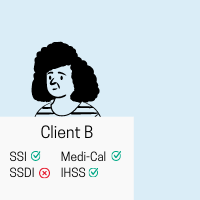

Almost every beneficiary of a Special Needs Trust saves significantly more than the cost of the Trust. This is because on top of earned investment income, putting your money in a Special Needs Trusts allows you to keep your SSI, Medi-Cal, IHSS and other vital benefits. Your exact savings will depend on your exact situation, but here are some examples of how special needs trusts can save clients with disabilities money every year:

|  |  |

|

|---|---|---|---|

| Amount in Trust | $30,000 | $50,000 | $120,000 |

| Annual JLA Fee | -$800 | -$800 | -$1,325 |

| Annual True Link Fee | -$300 | -$500 | -$1,200 |

| Annual Investment Earnings | +$2,900 | +$3,900 | +$7,100 |

| Annual Trust Earnings Minus Fees | $1,800 | $2,600 | $4,575 |

| |||

| Yearly SSI Income Saved | $13,175 | $12,215 | $11,615 |

This table shows examples (based on numbers from 2020). Actual experience might vary: some years you might use significantly less Medi-Cal expenses, and some years you might even see an investment loss. Regardless, we hope this chart shows why a special needs trust is worth the cost.