Investments

Money deposited with JLA Trust is pooled and invested.

Our trusts are professionally invested with Charles Schwab & Co., managed by our partners at True Link Financial. This gives our clients access to professional investment services to help increase their trust funds even while spending funds.

At the time of enrollment, each client selects one of the investment portfolios below, depending on the amount of risk they are willing to take on. Each trust earns income based on the performance of the chosen investment portfolio. For many of our clients, their trust’s investment earnings each year cover the fees paid on their trust account, but this will vary depending on overall market performance, the portfolio selected, and the amount of money in the trust, and is not guaranteed.

- Not Insured by the FDIC or Any Federal Government Agency

- Not a Deposit or Other Obligation of, or Guaranteed by, the Bank or Any Bank Affiliate

- Subject to Investment Risks, Including Possible Loss of the Principal Amount Invested

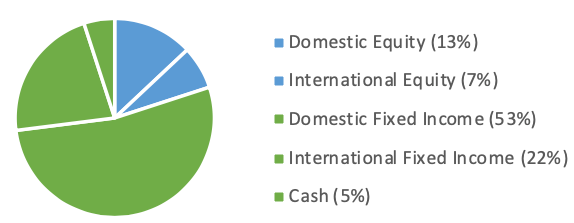

Conservative

Trust funds are invested carefully and conservatively but still with potential gains, with 80% fixed income and 20% equity. Historically, this portfolio has offered 3.4% returns, with 5.4% risk.

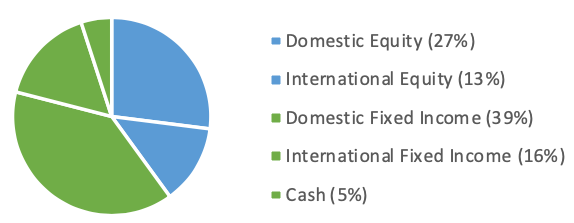

Conservative Growth

Trust funds are invested with a little more risk and a little more potential gain than conservative, with 60% fixed income and 40% equity. Historically, this portfolio has offered 4.3% returns, with 7.0% risk.

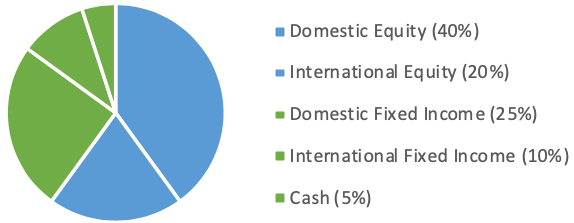

Moderate

Our greatest potential returns for those who want to take on a little more risk. A moderate growth portfolio is 40% fixed income and 60% equity. Historically, this portfolio has offered 5.1% returns, with 9.3% risk.